Micro-Finance in Cambodia Harms the Poor.

Once - when it consisted of community-based savings and self-help schemes

-

micro-finance

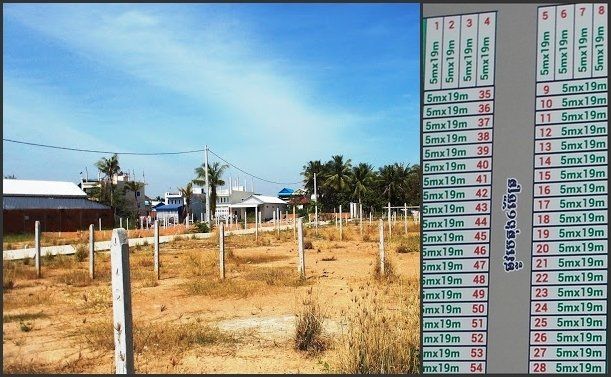

was a great way for poor people to work their way out-of-poverty. Then local bankers moved in and next some foreign ones, both motivated mainly by profit. They started charging interest rates of 20% and then as families defaulted, they recovered their toxic loans by acquiring their land having obtained titles as collateral. MFIs quickly off-load the land to speculators. Authorities side with the bankers.

Micro-finance in Cambodia has lost its way!

Cambodia Human Rights NGO LICADHO* published in 2019 a report setting out the dire situation of 26 families who had taken out MFIs loans. People like me had been issuing warnings

for years. Yet instead of accepting that what was highlighted is an accurate microcosm of the country the Cambodia Micro-Finance Association and National Bank of Cambodia issued denials.

* Declaration of Interest - I am on the Board of LICADHO

Please see also April 2021 update

links here in my blog updates.

Grave concerns based on personal observations

Those of us responsible for introducing micro-credit schemes in to Cambodia have expressed concern about the way it changed from its socially-responsible origins. The first sign of that, as explained by LICADHO, was the transition of ACLEDA from its humble origin to the country's largest bank. Other MFIs soon followed suit. Then when I encountered a case in 2017 with clear ethical issues, I met MFI leaders and called for a new Code of Conduct.

"MFI micro-credit increases poverty, not solve it."

That call and other representations attracted a lot of attention including from the World Bank. I had made the point that poor people facing loss of land loss - whether at the hand of MFIs or others - lacked rights to independent advice; legal representation, and proper compensation. This blog delves in to the details as well as giving links to how the story appeared in media and the official response from the Cambodia Micro-Finance Association and the Cambodia National Bank.

For updates and latest news - including articles - please go to my Blog.

The situation as in July 2020 is well-described

here

by David Hutt.

Royal Holloway London University researchers also issued

their study

reminding us that the issues are historic and international.

Read also here September 2020 how destitute families given much-needed cash relief during the Covid19 crisis must use it to pay off MFI loans.